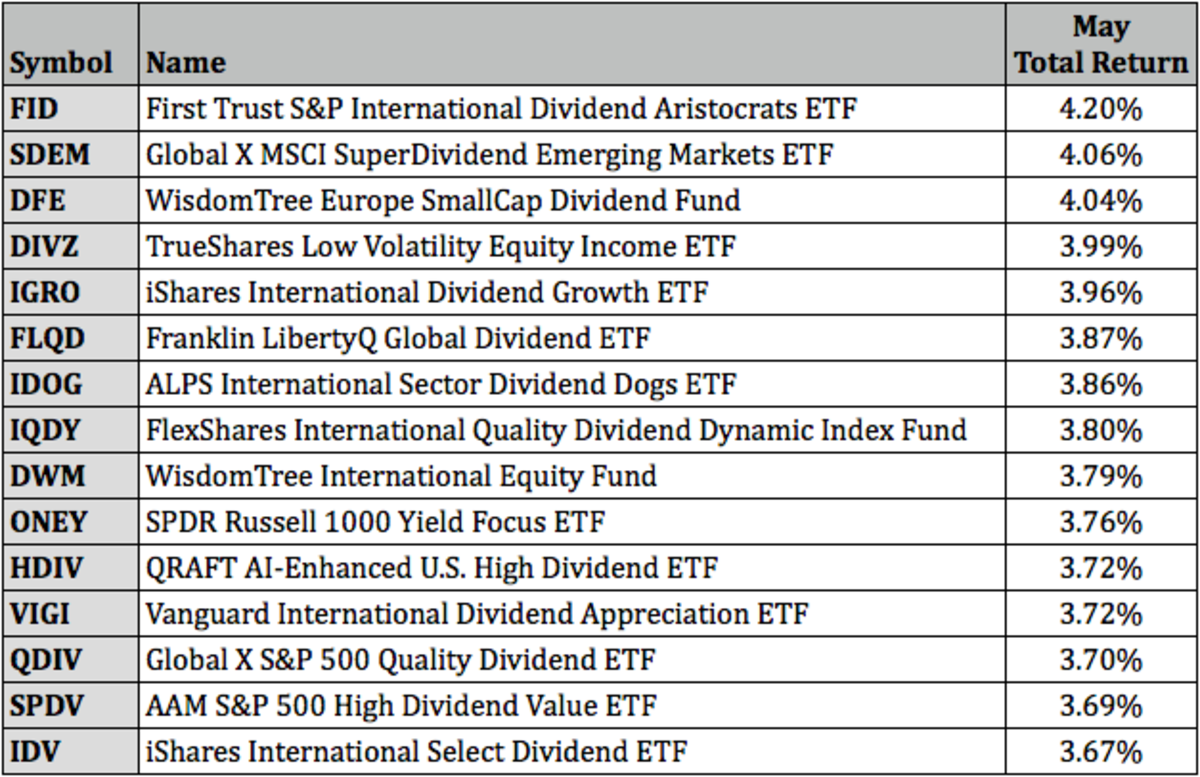

What follows is the list of top 30 exchange-traded funds with the highest dividend yield.

| # | ETF Symbol | ETF Name (Linked) | Dividend Yield | AUM (in millions) | Avg Daily Share Volume |

|---|---|---|---|---|---|

| 1 | MSFO | YieldMax MSFT Option Income Strategy ETF | 18.71% | $50.15 | 61,587 |

| 2 | TLTW | iShares 20+ Year Treasury Bond BuyWrite Strategy ETF | 18.61% | $905.40 | 561,048 |

| 3 | PYPY | YieldMax PYPL Option Income Strategy ETF | 18.59% | $15.28 | 21,813 |

| 4 | DISO | YieldMax DIS Option Income Strategy ETF | 17.75% | $13.14 | 11,957 |

| 5 | AMDS | GraniteShares 1x Short AMD Daily ETF | 17.60% | $1.62 | 66,232 |

| 6 | TIME | Clockwise Core Equity & Innovation ETF | 17.18% | $22.51 | 8,779 |

| 7 | BITO | ProShares Bitcoin Strategy ETF | 16.54% | $2,806.81 | 22,373,037 |

| 8 | SVOL | Simplify Volatility Premium ETF | 16.31% | $843.26 | 667,330 |

| 9 | MORT | VanEck Mortgage REIT Income ETF | 16.29% | $249.38 | 261,106 |

| 10 | TSDD | GraniteShares 2x Short TSLA Daily ETF | 15.50% | $3.65 | 78,968 |

| 11 | GOOY | YieldMax GOOGL Option Income Strategy ETF | 15.25% | $30.99 | 47,832 |

| 12 | KHYB | KraneShares Asia Pacific High Income Bond ETF | 14.98% | $14.79 | 3,921 |

| 13 | HYGW | iShares High Yield Corporate Bond BuyWrite Strategy ETF | 14.35% | $63.92 | 27,978 |

| 14 | KARB | Carbon Strategy ETF | 13.83% | $0.82 | 465 |

| 15 | BIZD | VanEck BDC Income ETF | 13.56% | $1,028.01 | 623,921 |

| 16 | BOAT | SonicShares Global Shipping ETF | 13.35% | $44.07 | 30,833 |

| 17 | TSLP | Kurv Yield Premium Strategy Tesla (TSLA) ETF | 13.23% | $1.76 | 6,124 |

| 18 | YBTC | Roundhill Bitcoin Covered Call Strategy ETF | 12.68% | $18.95 | N/A |

| 19 | JPMO | YieldMax JPM Option Income Strategy ETF | 12.41% | $13.62 | 11,662 |

| 20 | RYLD | Global X Russell 2000 Covered Call ETF | 12.21% | $1,409.87 | 711,451 |

| 21 | YYY | Amplify High Income ETF | 12.16% | $454.16 | 221,632 |

| 22 | XRMI | Global X S&P 500 Risk Managed Income ETF | 12.16% | $34.62 | 12,095 |

| 23 | KBWD | Invesco KBW High Dividend Yield Financial ETF | 12.07% | $365.29 | 128,106 |

| 24 | XCCC | BondBloxx CCC-Rated USD High Yield Corporate Bond ETF | 12.07% | $58.98 | 21,508 |

| 25 | QRMI | Global X NASDAQ 100 Risk Managed Income ETF | 12.06% | $13.06 | 7,502 |

| 26 | PEX | ProShares Global Listed Private Equity ETF | 12.00% | $9.62 | 2,622 |

| 27 | TYLG | Global X Information Technology Covered Call & Growth ETF | 11.86% | $8.19 | 3,443 |

| 28 | SDIV | Global X SuperDividend ETF | 11.80% | $749.98 | 241,259 |

| 29 | SPYI | NEOS S&P 500 High Income ETF | 11.70% | $1,126.67 | 401,703 |

| 30 | SARK | AXS Short Innovation Daily ETF | 11.68% | $136.72 | 1,561,641 |

Analysis of Highest Dividend Yield ETFs

HISTORICAL ANALYSIS OF HIGH DIVIDEND YIELDS

An examination of historical performance shows critical patterns for ETFs that have high dividend yields. For one, the YieldMax MSFT Option Income Strategy ETF has maintained an outstanding high yield over the past year, 18.71% . As with other high yielding ETFs, it is likely to attract the attention of income-seeking investors in sectors stuck in downturns, where stability in income is deemed more valuable than explosive growth, which is rare in high yields . One may become a shareholder of the ProShares Bitcoin Strategy ETF with a dividend yield standing at 16.54%. It is a sound investment for a case where one needs to diversify one’s holding beyond securities into items that can both generate income and growth. One of the safety aspects of this ETF is its liquidity, as it is among the SSYS group, which boasts an average daily share volume of over 22 million .

CASE STUDIES OF NOTABLE HIGH YIELD ETFS

The dividend yield of the iShares 20+ Year Treasury Bond BuyWrite Strategy ETF is 18.61%, with $905 million in assets under management. There are two attractive features about this particular ETF. First, it has a superb yield, and second, it reveals how long-term bonds can be mixed with option strategies to improve income. In the meantime, the VanEck Vectors Mortgage REIT Income ETF serves as a prime illustration of sector-specific yields. Its yield is worth 16.29%, and the fact that its daily trading volume is not insignificant attests to a high level of interest and stability. Some people want to profit from shorting Advanced Micro Devices, which is possible with the GraniteShares 1x Short AMD Daily ETF, where the yield for those investors is 17.60% . It, thus, employs an investment strategy providing returns that relate inversely to those of AMD daily.

If I were to explore one of these 6 high yield, higher risk ETFs, I would choose GraniteShares 2x Short TSLA Daily ETF GraniteShares 2x Short TSLA Daily ETF, as Tesla is experiencing high growth, and it would be pretty risky to bet against it, so I think that I deserve an opportunity to choose a higher return on my investment. The purpose of this paper is to explore an ETF which is similar to GraniteShares 2x Short TSLA Daily ETF, and to showcase the key points of its offering and market niche to ultimately defferentiate it from the chosen ETF.

GraniteShares 2x Short TSLA Daily ETF

According to the information provided in the assignment description, GraniteShares 2x Short TSLA Daily ETF is an ETF with a yield of 15.50%, which is the highest among the options that have been suggested. Investors should be bearish on Tesla if they want to obtain stable returns from this ETF, as the ETF seeks to provide twice the inverse daily performance of its underlying stock, Tesla. The size and volume of this ETF are relatively low, so it can not boast a sufficient or high liquidity. That said, I believe that an adequate “premium” to expect is a potential doubling of the returns or losses demonstrated by Tesla, on condition that the investor made the right prediction about Tesla’s stock decline.

The KraneShares Asia Pacific High Income Bond ETF, with a yield slightly below that of the ETF which I chose to explore, at 14.98%, focuses on high income bonds from this region of the planet. Due to the low development of some countries, as well as the fact that most of these regions are emerging markets, the bonds of these nations will typically yield higher retuns than domestic bonds.

Spotlight on ETFs Yielding Between 30% to 50%

Historical analysis of exceptionally high dividend yields

Typically, ETFs offering yields between 30% to 50%, involve unique strategies or high-risk sectors. For example, During its peak, the Etracs Monthly Pay 2xLeveraged Mortgage REIT ETN also known as MORL provided yields close to 22%, by leveraging invested in mortgage real estate investments trusts . The leverage was sustainable during stable real estate markets and low-interest rate periods, which was ideal for the high yields experienced. However, the risk was huge during economic turndowns, which was accompanied with significant volatility.

Reasons why high yield ETFs may warrant your investment.

-

High-Yield ETFs can be ideal investments for individuals who want to make high income in the short term. For example, Credit Suisse X-Links Monthly Pay 2x Leveraged Mortgage REIT ETN also known as REML, offers a historically high yield or returns, which goes beyond 30%.

-

It is important to note that, high-yield ETFs typically deploy financial leverage, which means that the potential increases or losses in returns are amplified for the investor. Therefore, if you are an investor with relevant knowledge about finance and risk manaagement, then high-yielding ETFs can be ideal for your investment.

Broad Exposure through Diverse ETFs

-

Historical analysis of diversified ETFs

Whether we like it or not, history is the best judge of current accomplishments and trends making diversified ETFs worthy of history. The Vanguard Total Stock Market ETF has stood the ultimate test of time. Although virtually mirroring the CRSP US Total Market Index, the fund is based on VTI, which has offered resilient and steady growth. With about 8% per year in the last decade, diversified ETFs offer the most feasible investment opportunity to steady long-term gains.

-

Reasons to invest in bold diversified ETF

Diversified ETFs maintain broad market exposure. Just as VTI and International Stock ETF offer multidimensional exposure to our investment, they also help in risk reduction. It proves tedious, risky, and costly to invest in individual equities to replicate what these funds could offer. Moreover, they are designed to mirror global market performance, giving a balance in growth, value, and yield. Any investor wishing to retire early must have a fair share of these ETFs. This is applicable especially for persons that do not follow or have little skills in scrutinizing and analyzing the operations of individual companies.

-

Case examples of bold diversified ETF strategies

The SPDR S&P 500 ETF Trust is another outstanding example that offers ETF investors broader market exposure comprising of the U.S. largest companies. The funds, which also happen to be among the most traded so far, offer the convenience of widespread vending to shops like Amazon. Consequently, investors gain from the growing U.S. economy. Similarly, the Vanguard FTSE Emerging Markets ETF also offers diversification in trading through emerging markets in the technology sector in East Asia and financial services in Latin America, to mention a few.